Managing your 1099 forms is a crucial part of financial management. In the era of increasing scrutiny and compliance, your business cannot afford to make a mistake in this area. This article is designed to guide you through the nuances of managing 1099s in Acumatica ERP, helping you understand the ins and outs while preventing costly errors. Before diving into this guide, we must stress the significance of consulting your company’s accounting professionals or CPA to ensure alignment with specific tax laws and business requirements.

E-File Setup

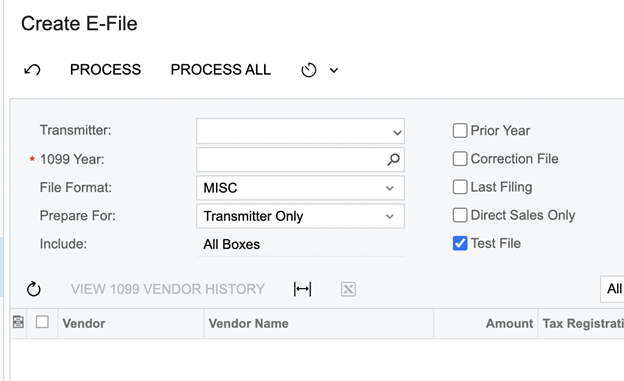

If your company works with more than 250 vendors requiring 1099 forms, the IRS mandates electronic filing via its FIRE system. To begin, navigate to Create E-File in Acumatica, click Test File, and download the file. You will need to load this file to request your FIRE account.

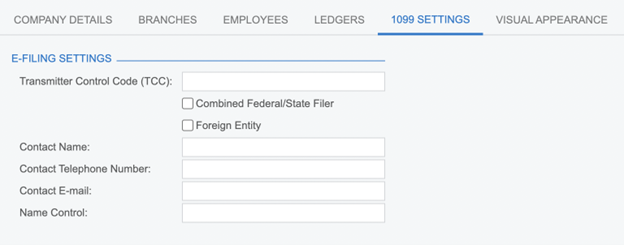

After you have a FIRE account, you can obtain a Transmitter Control Code (TCC) by having a company representative fill out IRS Form 4419 (Note, this must be completed by 12/15/2023 this year, so mark your calendar). After IRS approval, finish setting up your Acumatica settings for e-filing. In Acumatica’s Companies screen input your TCC in the “1099 Settings” tab. Conduct a final review with your accountant to confirm all information before proceeding with e-filing.

Designating 1099 Vendors

Navigating to Vendor Profile Settings: A Step-By-Step Approach

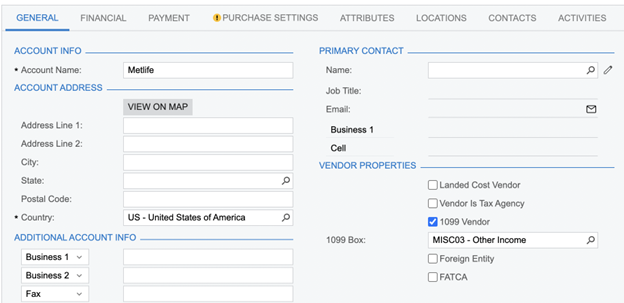

The Vendor profile can be easily located in the Payables module. Once there, you’ll find a “1099 Vendor” checkbox under the General tab. Checking this box will ensure payments are correctly tracked and reported.

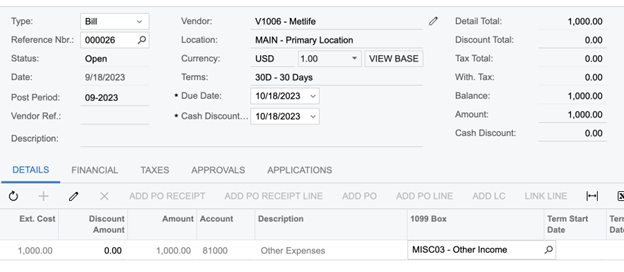

The 1099 Box

After you’ve identified a vendor as a 1099 entity, you’re presented with a dropdown menu where you can select the 1099 Box that most often applies to payments made to this vendor. Additionally, Acumatica provides the option to modify this on a per-bill basis. This means that even if a vendor typically receives payments that fit under a standard 1099 Box, you can adjust this for individual transactions, offering a level of customization that can be crucial for handling exceptions or unique payment types.

The Mechanics of 1099 Bills and Payments

Billing vs. Payment Dates: A Critical Distinction for Accurate Reporting

Understanding that the 1099 form is affected by the payment date rather than the invoice date is crucial for accurate tax reporting. For example, if you receive an invoice dated December 2021 but only pay it in January 2022, that payment should be included in your 2022 tax reporting. This nuance could easily be overlooked, leading to inaccuracies in your 1099 forms.

The Importance of Differentiating Between 1099-MISC and 1099-NEC Forms

Different types of payments require different types of 1099 forms. The two primary forms you’ll be dealing with are 1099-MISC and 1099-NEC. The system understands these nuances and helps you classify payments into these categories based on the designated 1099 Boxes.

| Form | Box |

| 1099-NEC | Box 7 Payments |

| 1099-MISC | All Other Box Payments |

Printing and Confirming Your 1099s

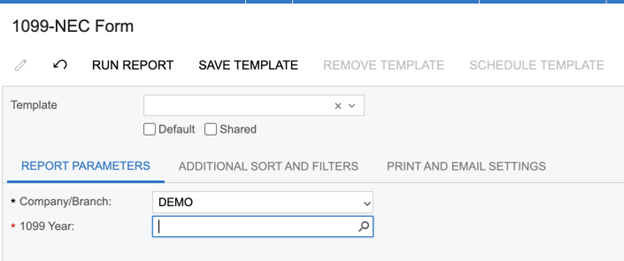

Access the 1099 Forms Within Acumatica

Acumatica ERP streamlines the process of generating your 1099 forms. By navigating to payables, you can select the “1099-MISC Form” and the “1099-NEC Form.” After choosing the tax year, Acumatica will prepare the forms for you.

Aligning with Official IRS Templates for Seamless Compliance

It’s crucial to note that the IRS requires you to use their official forms when printing 1099s. Acumatica has been designed to format the information so that it aligns perfectly with these official IRS templates. This feature ensures that you remain in full compliance with IRS requirements.

Double-Checking Is Not Optional: The Need for Accuracy Checks

Once Acumatica has generated your 1099 forms, don’t rush to print them out. Take the time to review them by running a “1099 Year Summary Report.” Check each entry for accuracy, as this is your last chance to catch and correct errors before they become a part of your official tax record. A thorough review at this stage can save you considerable time and hassle down the line.

What to Do When Your 1099 Data Doesn’t Add Up

There may be occasions when you discover discrepancies in your 1099 data, such as a missing vendor or unaccounted payments. Such errors are not uncommon and can arise for a variety of reasons like clerical oversights, data entry errors, or even software glitches. When this happens, it’s not the end of the world. Acumatica provides robust solutions to identify and rectify these issues.

Steps for Rectifying Vendor and Payment Errors

If you find that a vendor is missing from your 1099 report or a certain payment isn’t reflected properly, the first step is to revisit the Vendor’s profile in Acumatica. There, you can update their status to be a 1099 vendor if that was an oversight. Next, scrutinize all bills related to that vendor for the concerned tax year. Manually update the “1099 Box” for each bill that requires it. After these corrections, you’ll need to regenerate your 1099 reports to ensure everything now aligns correctly. This may seem tedious but is absolutely essential for maintaining financial and tax compliance.

Finalizing and Locking the Year: The Last Hurdle

Closing the Books: Final Steps and Precautions

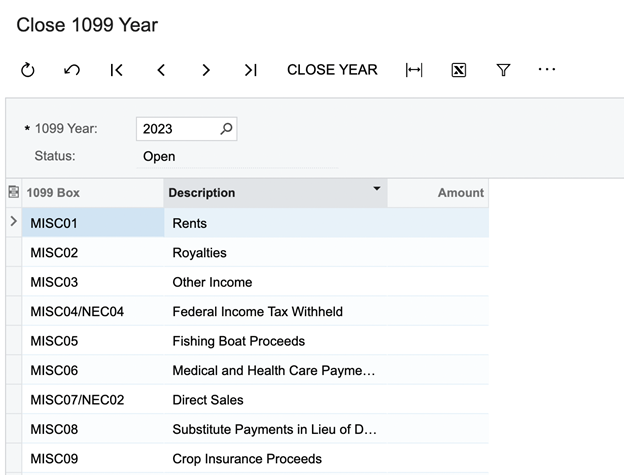

When you’re confident that your 1099 forms are accurate and complete, it’s time to close the books for that fiscal year. Acumatica allows you to lock the fiscal year, preventing any future changes to the finalized data. This ensures that your 1099 forms will remain consistent and helps avoid accidental changes that might lead to discrepancies.

Before making the commitment to close the fiscal year, Acumatica provides a summary screen that offers a condensed but comprehensive view of all 1099-related activities for that year. It’s crucial to spend a few minutes reviewing this summary. Confirm that all entries are correct and that all vendors are appropriately categorized. Once satisfied, you can confidently hit “Close Year,” signifying the successful completion of your 1099 management for that fiscal year.

Reports for Audit and Compliance

Archiving and Record-Keeping

For auditing purposes, it’s imperative to keep a complete record of all your 1099 forms and related financial transactions. Acumatica allows you to archive these records digitally, ensuring they are readily available in case of an audit. While digital archiving is convenient, it’s also wise to maintain a physical copy of these records as an additional layer of security.

Acumatica offers several built-in reporting tools that can help you stay on top of your 1099 compliance requirements. These reports can be scheduled to run at regular intervals, providing continuous oversight of your financial operations. This proactive approach can help you identify potential issues long before they become actual problems, allowing for timely corrective action.

Summary

This expanded guide aims to be a comprehensive resource for mastering 1099 management in Acumatica ERP. By following these detailed steps and insights, you will be better equipped to handle this crucial aspect of your financial operations with confidence and accuracy.