As we mentioned in a recent blog, Sage 100 2022 is worth upgrading. The latest version of Sage 100 Payroll includes some nice improvements as well.

Sage 100 Payroll 2.22.3 was released in September and should be installed to get the updates.

What’s new in PR2.22.3? Here are a few highlights. You can read the complete release notes here.

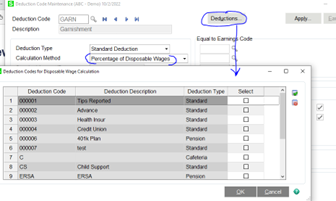

- Sage 100 Payroll now has the ability to calculate Deductions using a percentage of Disposable Wages. You can choose which non-employer contribution deductions should be included in the calculation of the disposable wage.

- Reset Deduction Balance at Year End ability added for all deduction types in Deduction Code Maintenance.

- There is now a Maximum Income Multiplier available.

- The ability to create Accounts Payable invoices from Payroll for payroll taxes and deductions has been added.

- In the Payroll Tax Liability Report, Federal Unemployment Tax now prints in its own Tax Group section.

- YTD earnings hours per earnings and total year-to-date earnings hours for all earnings have been added as fields for Check Printing.

- Updates and fixes to local wages and taxes for Wilmington, DE, and Philadelphia, PA, and more!

In case you missed it, other recent Sage 100 Payroll enhancements include:

- The ability to pay employees in other pay cycles to Payroll Data Entry

- Employer Social Security taxes on Emergency COVID earnings are now included in the tax liability amounts reported in Part 2 of the 941 Form for 2021.

Emerald TC provides software and consulting for manufacturing companies. We can help you choose the right ERP system for your needs. Contact us or call 678-456-6919 for more information.